What Levers to Optimize NOI Are Left?

Two years into the COVID-19 pandemic and much of the U.S. commercial and multifamily markets are now returning to the new ‘business as usual’, albeit with a twist. Workers are trekking back to the office from their WFH lifestyle to some version of a hybrid work environment.

And asset managers are now asking the question “How can I make more money at my property?” after navigating rent moratoriums and a bout of flat rents during those dark days.

With occupancy no longer the primary challenge to increase rental profit in many markets, owners and operators need to run their properties more efficiently moving from a growth focus to an optimization focus. But where to look to find sources of trapped value?

When looking at operating statements, there are typically only a couple of things left for asset managers to evaluate and potentially adjust:

- Taxes? Owners can’t do much about those other than groan.

- Refi? Possible, but many have already pursued this route.

And fixed costs are just that…fixed. The current perception among most operators is that there’s not much left to improve.

Or is there? The answer is yes.

There continues to be meaningful trapped value in marketing spend and labor costs, but to unlock that value requires better tools and information.

Applying new, purpose-built technology, owners and operators can find the last vestiges of NOI increases available.

For instance, if an owner-operator has a 10,000-unit portfolio, with an industry average retention rate of 50%, that means they are going to need to lease 5,000 units in a year. With a Class-A industry average cost per lease of $600 they are looking at $3,000,000 in ad spend.

Now let’s think about the marketing head count required to support those 10,000 units: perhaps a Marketing Coordinator, a Digital Marketing Manager, and a Marketing Director. Fully loaded, they are looking at another $400k – $500k per year required to plan, manage, and analyze the marketing investments.

What if you could automate most of the manual work the team was doing and could get actionable insights into:

- How properties are performing against exposure goals?

- What are the marketing and leasing risk areas I should be paying attention to?

- Which marketing channels are working and which ones aren’t?

- What’s the ROI on every marketing dollar I’m spending?

- What of my spend works best for what unit types?

And, what if, as a result of that automation and faster, easier decision making, they were able to:

- Lower average cost per lead and lease?

- Increase speed to asset stabilization?

- Expand the portfolio without having to further add headcount?

Would that be of interest?

This represents a fundamental shift in expectations around your return on your marketing investment in both people and spend. You can move Marketing from being seen as a ‘necessary but soft benefit’ cost center into a strategic, revenue producing, predictable lever in the asset management function.

So, what’s required to achieve this transformation?

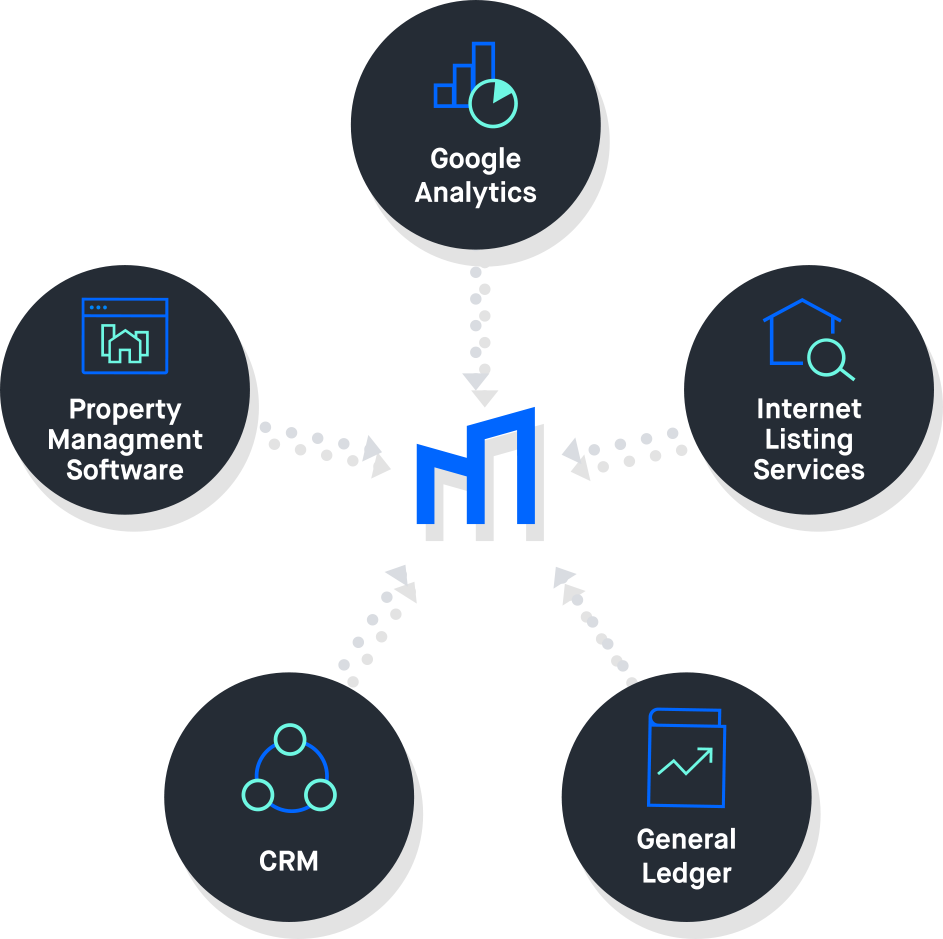

- Data Aggregation: Relieve your team’s need to spend hours logging into multiple different systems and instances to get the data they need to calculate and share important metrics like conversion rates or costs per lead and lease.

- Data Visualization: Empower your teams to analyze historically complex, disparate data sets in seconds, via visualizations that quickly illustrate performance, week over week, month over month, or year over year.

- Programmatic Insight Generation: Data is only as powerful as the actions it drives. Without the ability to convert data into insights and then action, the data is just noise. Now, technology can help meet this need. This might come in the form of:

- Narrative insights that convert hundreds of data points into plain language at the click of a button.

- Machine-learning powered forecasts that convert historical performance into future trends

- Monitoring and alerting functionality that tells you exactly what property and what stage of the funnel is below benchmark standard – before it’s too late.

- Top and bottom paid marketing sources – sortable by volumes, conversion rates, cost pers, revenue and ROI.

- Best paid marketing sources for exposure – sortable by average bedrooms, bathrooms, square footage and rent per square foot.

Here’s a great example of current multifamily marketing intelligence challenges. I spoke with a Marketing Director at an NMHC Top 10 Manager the other day who shared that she oversees 30+ properties across seven different Yardi instances. Seven! On top of those seven different Yardi systems, she has to login to multiple other CRMs, Google Analytics accounts, and G-Sheets, just to answer basic questions about cost per lead, cost per lease, and traffic sources.

Leveraging technology now available, such as a multifamily marketing business intelligence solution, you can empower and transform your marketing team and enable them to produce better, faster, more cost-effective performance that delivers every last penny of NOI from a property.

It is this kind of optimization that is top of mind for the industry’s leading owners, operators, and asset managers.

“On top of leveraging technology to help reduce your overall spend, it also ensures that you “spend better,” no matter how much money you’re willing to allocate to marketing. I want to know that every dollar I’m investing is producing the highest possible ROI and want to see quantifiable proof that this is happening.”

Jay Remillard, Director of Asset Management at CP Capital US

**

About Remarkably

To learn more about how Remarkably, the industry’s first ever marketing business intelligence solution, can help you drive higher leasing revenue, more efficiently, at lower cost, with better ROI visit here or schedule your personalized demo today.