Multifamily Marketing is Key to Portfolio Performance

Consider the following core facts about the multifamily industry:

- In the U.S there are 74,000 communities with 50+ units.

- Across those 74,000 communities there are 17,344,000 units, which represents 56% of all U.S unit stock.

- Industry average is 50% turnover each year, meaning that 8,672,000 units must be leased annually.

- At a conservative $600 Cost per Lease that equates to $5.2B in marketing advertising spend; And keep in mind, many properties, particularly new, Class-A, or conversely struggling assets pay well over $600 per lease.

$5 Billion Dollars + is what our industry spends in advertising hard costs alone to market its vacancies every year.

And yet some in the industry continue to insist that marketing analytics and marketing business intelligence don’t matter.

We disagree.

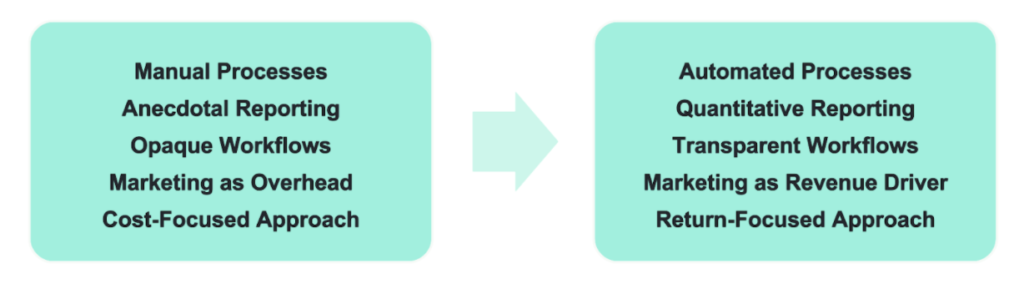

The bottom line is that multifamily marketing has become key to portfolio performance, yet it lacks the tools other institutional functions enjoy.

An increasingly competitive landscape compounded by COVID-related challenges have recently made marketing an even more critical discipline in achieving portfolio goals.

Historically undervalued as creative overhead, marketing teams have lacked effective vertical BI tools to support strategic decision-making.

Until now.

At Remarkably, our vision is to transform the role, value, and impact of

multifamily marketing: enabling people, teams and portfolios to

achieve exceptional returns on their investments.

What’s your marketing team’s impact on ROI?

Not sure your properties and portfolios need to understand, measure, and optimize your marketing ROI?

This calculator will let you easily explore what you’re spending on annual marketing spend, and how much you could be saving through leveraging data and technology to reduce spend.

How to Use the Marketing Impact Calculator?

We’ll ask you a few details about your portfolio, including:

- # of Units

- Average portfolio retention rate

- Average cost per lease

- Average monthly rent in portfolio

If you don’t know the exact values for your portfolio, use a region, a group of local properties, or an individual property where you’re familiar with the numbers.

Then, we will calculate, based on a selection of optimization scenarios you can choose from, the estimated annual savings and your marketing team’s impact on ROI.